Shares of the social networking business have been trading closer to Mr. Musk’s proposed price, indicating that investors are becoming more optimistic that a deal can be reached.

Expectations that Twitter Inc. could conclude a deal to sell itself to Elon Musk as soon as Monday boosted the stock.

During late morning trade, shares of the social networking business rose 3.8 percent to $50.80. The stock of Twitter has been swinging wildly this month as investors have followed Elon Musk’s offer to buy the San Francisco-based company.

The two sides met on Sunday to discuss Mr. Musk’s suggestion, according to the Wall Street Journal. Mr. Musk is the CEO of Tesla Inc. TSLA -1.20 percent and one of Twitter’s most prominent and vociferous users. The parties laboured through the night to come up with a settlement worth $54.20 per share. The two sides are in advanced talks and could reach an agreement by Monday.

The advanced conversations are a sharp contrast to earlier this month, when Mr. Musk’s bid was likely to be rejected by Twitter. That changed after Mr. Musk said that he had secured $46.5 billion in funding to support his bid for the company.

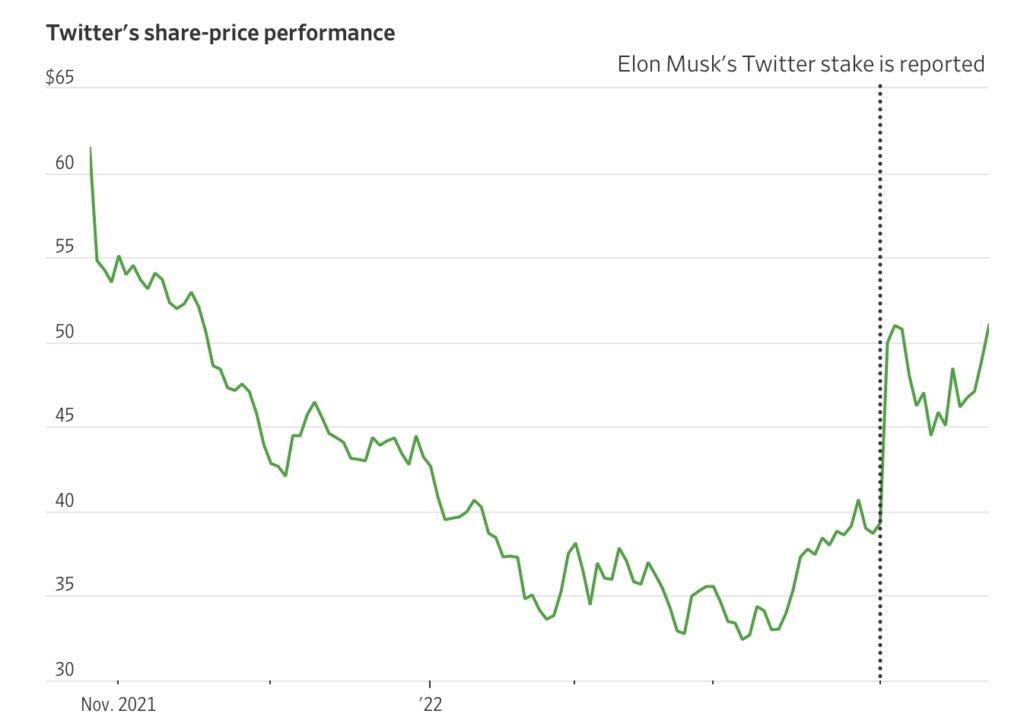

Mr. Musk has stated that his $54.20-per-share offer is his “best and last” offer. Twitter’s stock last traded above $54.20 in November of 2021.

Twitter’s stock is currently trading around 6% below Mr. Musk’s offer, at $50.80 per share, indicating that investors are growing more optimistic that a transaction can be reached.

Twitter shares have risen over 30% since Mr. Musk declared a roughly 9% investment in the company in early April. On a year-to-date basis, this has driven Twitter higher, surpassing other technology businesses and the broader market. The S&P 500 has lost nearly 11% this year.

On Thursday, Twitter is set to release its first-quarter profits. According to FactSet statistics, analysts predict the company will report more revenue but lower net income than the previous year.

Mr. Musk has stated that he intends to make significant changes to Twitter, stating that the firm should move toward a subscription-based economic model. He’s also suggested that Twitter’s attitude on content control be softened.

Individual investors have flocked to Mr. Musk’s bid for the platform, pouring a net $747 million into the stock in April, according to Vanda Research data through Friday. That’s about ten times the group’s average monthly buy in 2021. Mr. Musk has amassed a devoted following of individual investors as the CEO of Tesla. The electric vehicle maker’s stock fell 2.1 percent on Monday.